Optimizing Investment Gains: STP in Mutual Funds and Its Benefits in India

Systematic Transfer Plan (STP) in mutual funds is a strategic investment approach that allows you to optimize your returns and manage risk. It’s an efficient way to move funds from one scheme to another while enjoying the benefits of both. Here, we’ll explore STP in mutual funds, its advantages, and how it can help individuals achieve their financial goals in India.

- The Importance of Strategic Investment; Here, we’ll discuss the significance of strategic investment in India and why it’s a valuable approach for optimizing returns and risk management.

- Understanding STP in Mutual Funds; Learn about what STP is, how it works, and the various scenarios in which it can be beneficial in the Indian financial landscape.

- Setting Up an STP; Discover how to set up an STP in mutual funds, including selecting the source and target schemes, specifying the transfer frequency, and determining the amount to be transferred.

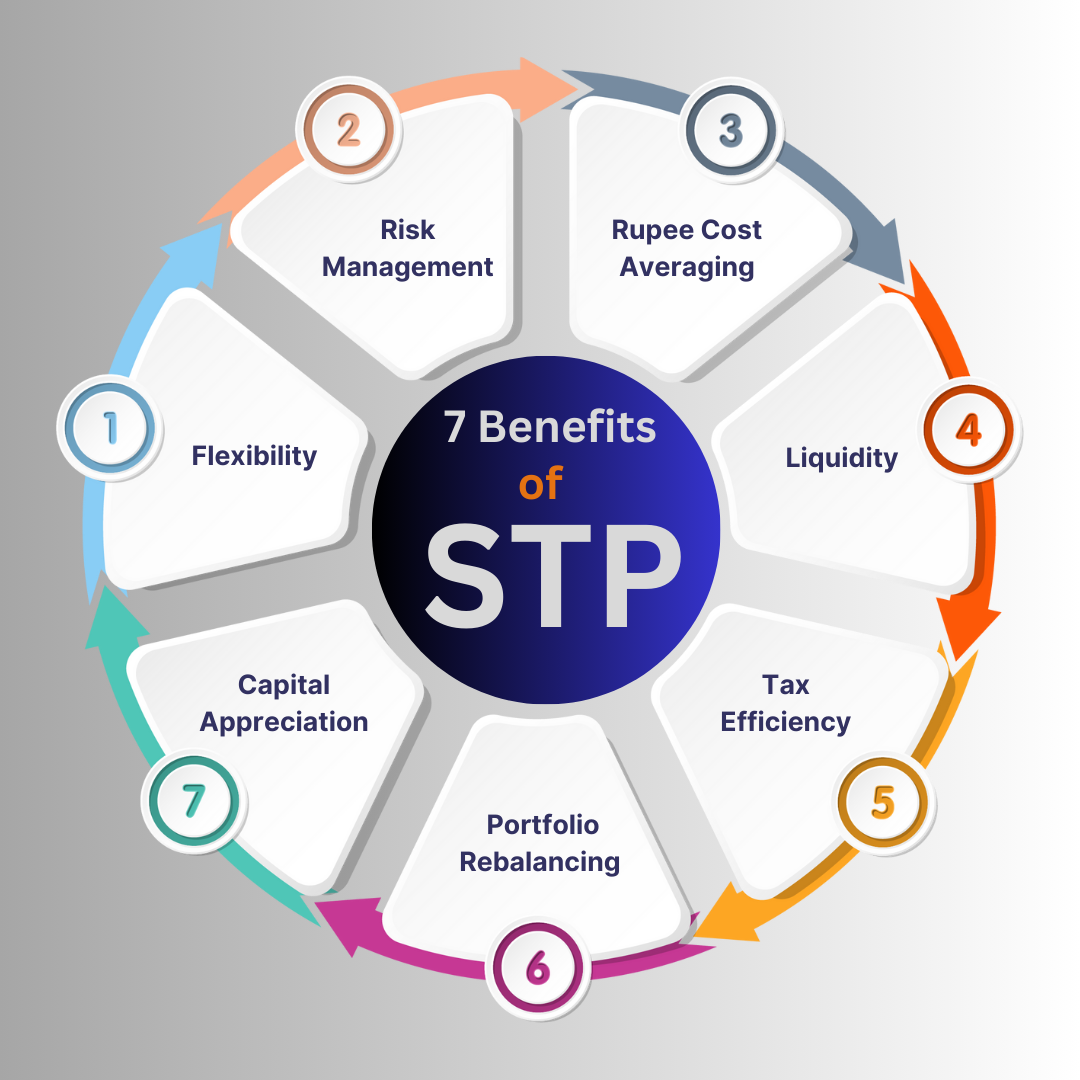

- Benefits of STP Investments; Explore the advantages of investing through STP, including capitalizing on market opportunities, risk mitigation, and achieving the dual benefits of both schemes.

- Goal-Oriented Investing with STP; Learn how STP can be aligned with various financial goals, including wealth accumulation, capital preservation, and income generation.

- Tax Benefits of STP Investments; Understand the tax implications and benefits of investing through STP, including the tax treatment of capital gains.

- Risk Management with STP; STP investments provide an effective means of managing market risk and volatility. We’ll discuss how STP can align with your risk tolerance and financial objectives.

- Monitoring and Reviewing STP Investments; Discover the importance of monitoring and periodically reviewing your STP investments to ensure they stay aligned with your goals.

- STP vs. SIP vs. Lump-Sum Investments; Understand the differences between STP, SIP, and lump-sum investments and when each approach may be suitable for investors in India.

- The Future of STP Investments in India; STP investments are evolving with digital advancements. This chapter offers insights into the future trends and innovations in the field.

Conclusion: Maximizing Returns through STP in mutual funds offers a strategic and flexible approach to investment that can optimize your returns and manage risk. By exploring the information provided here, you’ll be well-prepared to leverage the benefits of STP for your financial growth and security in India.

Contact Us: If you have questions or need personalized assistance with STP investments in India, feel free to contact us. We’re here to help you navigate the world of strategic investing and wealth optimization.