Financial Freedom with SWP: Mutual Funds and Their Benefits in India

Systematic Withdrawal Plan (SWP) in mutual funds is a smart financial strategy that empowers investors to access a regular stream of income while keeping their investments intact. Here, we’ll explore the concept of SWP in mutual funds, its advantages, and how it can help individuals achieve financial independence and security in India.

- The Quest for Financial Freedom; Here, we’ll discuss the aspiration for financial freedom in the Indian context and why it’s a crucial goal for long-term financial planning.

- Understanding SWP in Mutual Funds; Learn about what SWP is, how it works, and how it differs from other investment approaches in the Indian financial landscape.

- Setting Up an SWP; Discover how to set up an SWP in mutual funds, including choosing the fund, determining withdrawal frequency, and specifying the withdrawal amount.

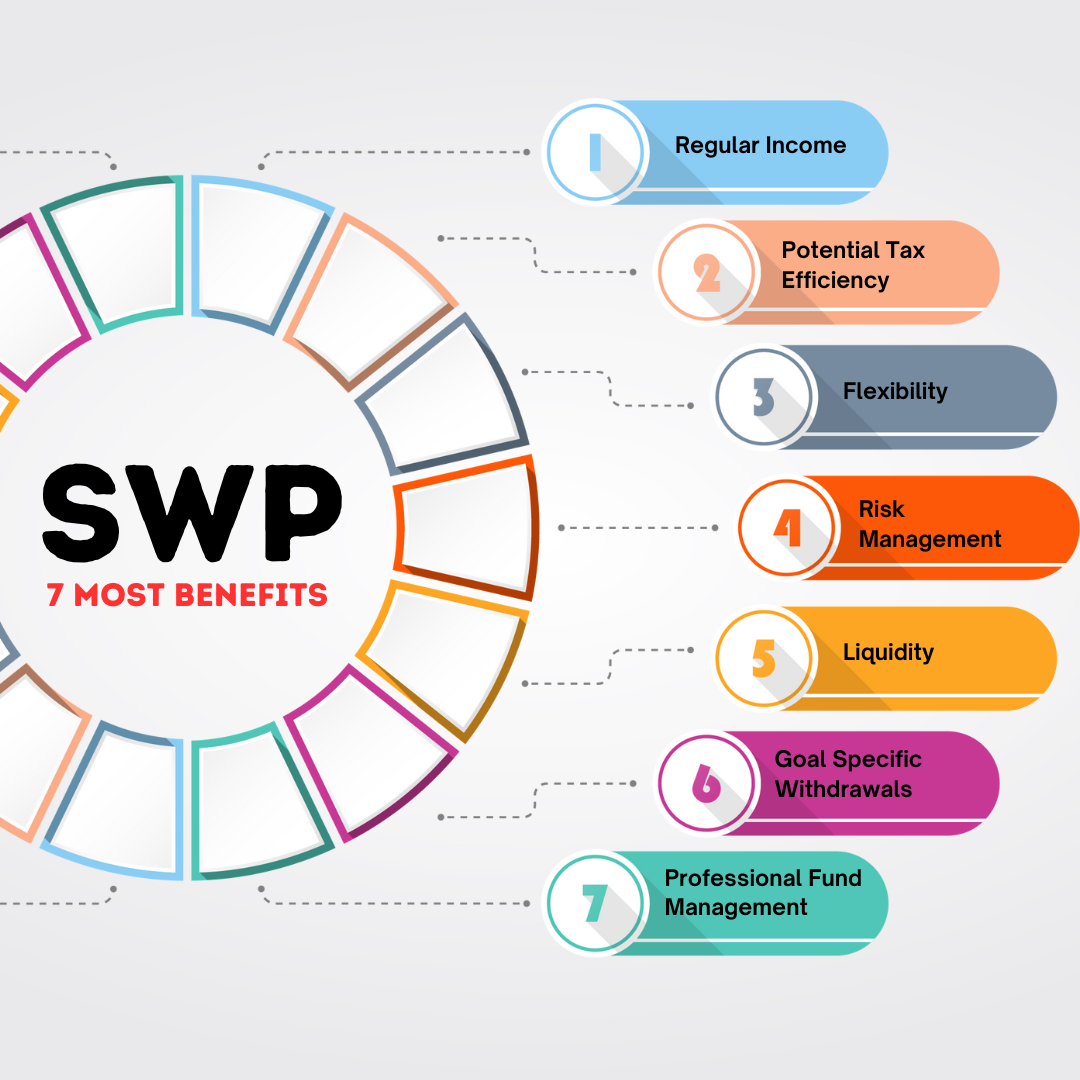

- Benefits of SWP Investments; Explore the advantages of SWP, including regular income, capital preservation, and the potential for growth through market appreciation.

- Goal-Oriented Investing with SWP; Learn how SWP can be aligned with various financial goals, including retirement income, funding education, and supplementing existing income.

- Tax Benefits of SWP Investments; Understand the tax implications and benefits of investing through SWP, including the tax treatment of withdrawals and capital gains.

- Risk Management with SWP; SWP investments offer a strategic means of managing market risk and preserving capital. We’ll discuss how SWP can align with your risk tolerance and financial objectives.

- Monitoring and Reviewing SWP Investments; Discover the importance of monitoring and periodically reviewing your SWP investments to ensure they remain aligned with your financial goals.

- SWP vs. Annuities and Other Income Options; Understand the differences between SWP, annuities, and other income options and when each may be suitable for investors in India.

- The Future of SWP Investments in India; SWP investments are evolving with digital advancements. This chapter offers insights into the future trends and innovations in the field.

Conclusion: Achieving Financial Independence with SWP in mutual funds offers a practical and flexible approach to securing financial independence. By exploring the information provided here, you’ll be well-prepared to leverage the benefits of SWP for your long-term financial security in India.

Contact Us: If you have questions or need personalized assistance with SWP investments in India, feel free to contact us. We’re here to help you navigate the world of systematic withdrawals and financial independence.